A Limited Liability Company, or LLC, is a type of business that protects the owners and their assets. According to the Delaware Division of Corporations, there was an 8.72% growth in LLCs by the end of 2020.

Many startups choose to start an LLC because of its many benefits and easy maintenance features. Whether you are starting a Florida LLC or travel up the coast to form an LLC in Delaware, this article will explore how entrepreneurs are able to start a new LLC on American soil.

What is an LLC?

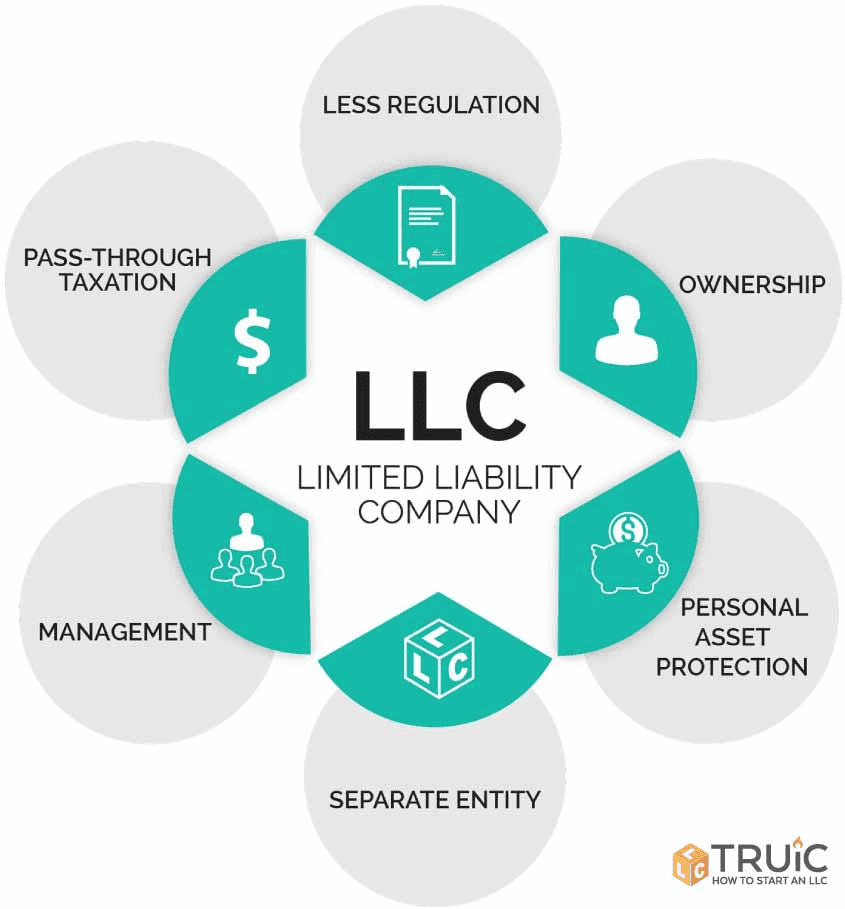

An LLC is a business structure, created in the United States, that acts to protect business owners. The protection acts to protect the owners from being personally liable for their company’s debts and/or other liabilities.

An LLC is a hybrid entity and combines the benefits of a partnership and sole proprietorship structures. LLCs are able to be owned by one person, but also by multiple people who are known as LLC members. Single-member LLCs and multi-member LLCs are pass-through entities.

This means that the profits and losses from the LLC are taxed as personal income by the owner/owners. LLCs also have the option of choosing to be taxed as a C corporation or an S corporation.

LLCs offer a multitude of benefits. The main advantages are personal asset protection and pass-through taxation.

It also offers simplicity because LLCs are easy to create and maintain, flexibility because of the little restrictions on the structure, ownership, and management, as well as credibility because an LLC is a widely recognized business structure that reassures customers and clients.

LLC additionally allows businesses access to business loans because of credit that is able to be built as well as flexible profit distribution among multiple owners.

Starting an LLC

Selecting a State

The first step is selecting the state in which the LLC will operate. Most business owners will decide to start the LLC in the state where they live or where the business is located.

If the business has other branches in other states, they would be required to start a foreign register in each state where the business is located. Business owners do have the option to form their LLC in a different state from where they live even if their business is not located there.

Some states, such as Delaware and Nevada, offer business-friendly laws and these are attractive to some business owners. Although the laws may seem tempting, business owners need to keep in mind that starting an LLC in another state may cost expensive fees and additional paperwork.

Naming the LLC

Choosing a business name is not a simple process. The rules for naming is not the same in all states, but the general guidelines are that the name should include the phrase “limited liability company” or the abbreviation, the name cannot include words that are related to a government agency, and if it uses restricted words, like “bank,” “attorney” or “university”, it may require additional paperwork and the inclusion of a licensed individual.

Choose a Registered Agent

LLCs need to choose a registered agent, which is a person or business designated to send and receive legal documents, such as legal summons and document filings, on behalf of the LLC. The majority of states require LLCs in those states to use a registered agent who is a resident of that state.

Filing the Articles of Organization

The following step would be to register the LLC with the state. The formation documents are commonly called “articles of organization”, “certificate of formation” or “certificate of organization.” Along with the articles of organization, LLCs would need to provide:

- Full names and contact information for all founding members

- The business name

- The businesses address

- Length of time the company has existed

- The registered agent’s information

- Information about the LLC, a mission statement, and an explanation of the purpose

Creating an Operating Agreement

This is a legal document that acts to outline the ownership structure of the LLC as well as the member roles. This agreement is not required by all states, but it is a beneficial document to form to have all important information on record. The general sections to be included in the agreement would be:

- Organization covers when and where the company was created, who the members are, and what the ownership structure is.

- Management and Voting which covers how the company is managed.

- Capital contributions cover what members financially support the LLC.

- Distributions that lays out how the company’s profits and losses are to be shared amongst the members.

- Dissolution explains the circumstances under which the LLC may be dissolved if it were to happen.

The Bottom Line

Given the many benefits of an LLC, providing flexibility, and being beneficial from a tax standpoint, starting an LLC as a startup may be a smart step towards business success.

Although this business structure may be tempting, entrepreneurs need to first consider and investigate their long and short-term goals. This would assist them in determining whether an LLC is the business structure for them.