Meetings conducted by the G20 and the Organization for Economic Co-operation and Development saw 132 countries committing to a global minimum corporate tax rate on multinationals of at least 15 percent on the 10th of July, 2021.

This proposed rate aims to stop decades of falling rates and aims to shake up calculations of where and how global companies operate from a fiscal standpoint.

But this proposed rate has not been implemented yet, which has allowed tax rates and company formation to vary across the EU and US.

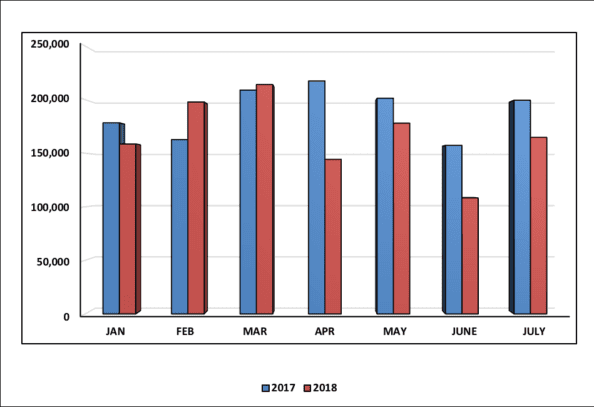

Corporate taxes in the EU

The EU has no fixed tax rates, which means the tax rates differ across countries. Due to this, the EU has an average corporate tax rate of roughly 21%. Countries, such as Portugal, Germany, and France, charge the highest rates ranging between 28% and 32%.

Countries, such as Hungary, Guernsey, and Cyprus, charge the lowest rates ranging between 0% and 12.5%.

Although there are no fixed rates, the EU does have a regulation that applies to all members of the EU: multinational corporations and large domestic companies based in Europe have to disclose all information about their revenue and taxes. This regulation came into effect in June 2021 by the EU government.

Corporate taxes in the US

The US corporate tax for domestic and multinational corporations was proposed to be raised from 21% to 28% by President Biden. President Biden’s proposal aims to narrow the gap of wealth distribution, create jobs, as well as to improve infrastructure.

This proposal has not been welcomed by all, especially lawmakers seeing that this will launch the US into a higher corporate tax bracket than the 23.5% average corporate tax rate of industrialized nations in the OECD.

Currently, due to the Tax Cuts and Jobs Act, introduced by President Trump, the 21% corporate tax rate reached an average of 25.8% when it has been combined with state-corporate taxes.

State-corporate taxes range from 0% to 11.5% in the US, with Texas, Nevada, Washington, Wyoming, and South Dakota having the lowest rates, and New Jersey having the highest rates.

Company Formation

The differing, and changing, tax rates across the US and EU prove to either be attractive or unattractive to entrepreneurs looking to form a new LLC. Countries in the EU, namely Hungary, Guernsey, and Cyprus, are the most attractive countries for entrepreneurs.

This applies to many states in the US as well, namely Texas, Nevada, Washington, Wyoming, and South Dakota.

LLCs have been shown to be the preferred business type by many entrepreneurs due to their many benefits. An LLC, which is a hybrid entity that combines the benefits of a partnership and sole proprietorship structures, has benefits such as personal asset protection and pass-through taxation.

LLC formation in the US is simple, but the process does differ across states. There are general steps every entrepreneur will have to follow if forming an LLC, such as:

Selecting a State

Most business owners will decide to start the LLC in the state where they live or where the business is located. If the business has other branches in other states, they would be required to start a foreign register in each state where the business is located.

Naming the LLC

The rules for naming is not the same in all states, but the general guidelines are that the name should include the phrase “limited liability company” or the abbreviation, the name cannot include words that are related to a government agency, and if it uses restricted words, like “bank,” “attorney” or “university”, it may require additional paperwork and the inclusion of a licensed individual.

Choose a Registered Agent

LLCs need to choose a registered agent, which is a person or business designated to send and receive legal documents, such as legal summons and document filings, on behalf of the LLC.

Filing the Articles of Organization

The following step would be to register the LLC with the state. The formation documents are commonly called “articles of organization”, “certificate of formation” or “certificate of organization.”

Creating an Operating Agreement

This is a legal document that acts to outline the ownership structure of the LLC as well as the member roles. This agreement is not required by all states, but it is a beneficial document to form to have all important information on record.

Obtaining an EIN

Business owners would then have to apply to the IRS for an employer identification number (EIN). This would be used on bank accounts as well as income and employment tax filings.

The takeaway

Although different states, or countries, have more attractive corporate tax rates, it might not always be the best fit. Business owners need to evaluate their business needs and goals to determine where it is best to form a business.

The same applies to choosing a business structure. For entrepreneurs interested in forming an LLC, The Really Useful Information Company (TRUiC) is able to offer more information.