Life can be hectic and stressful. For this reason, most people welcome ways to save themselves time when they’re performing crucial tasks, such as doing their taxes.

More than a quarter of all Americans hate doing taxes, and overall, most people have negative feelings about filing taxes. In 2013, 31 percent of people surveyed felt filing taxes is too complicated, while another 24 percent didn’t like doing taxes because of the time required to complete the task. Fortunately, using tax envelopes and other resources can save you time and help you avoid confusion when you’re filing your taxes.

What Are Some Examples of Tax Resources?

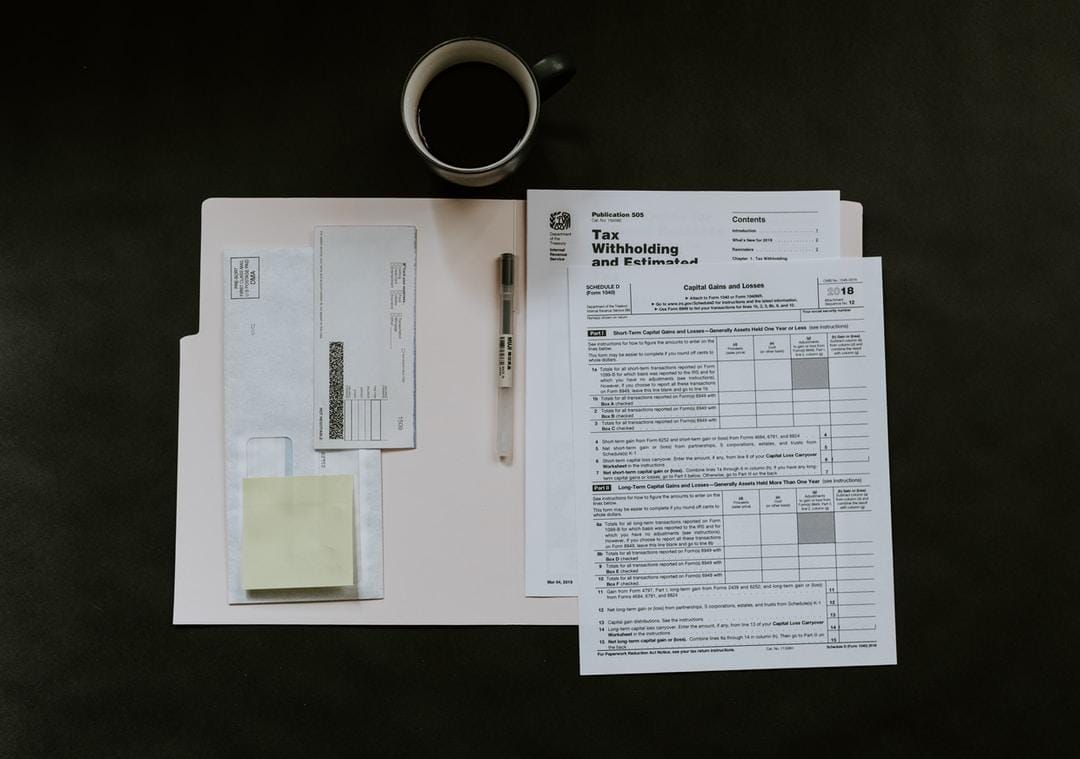

Tax resources include stationery products designed to make it easier to file your taxes. Choose from various tax return envelopes designed for the leading tax software programs. You can have your address printed on tax form envelopes, or you can opt for tax form envelopes with windows.

Other tax return stationery products include tax folders and tax forms. Tax return folders are marketed to tax accountants who can use the folders to secure client documents. Using folders ensures the tax reports look professional and impress clients. The pockets make it possible to keep documents organized inside the folders. The folders have slits for inserting business cards, ensuring accountants can include their contact information with the package. Businesses can purchase tax forms, including W-2 Forms and 1099 Forms.

The Internal Revenue Service (IRS) also provides resources individuals and businesses can refer to when preparing tax documents and filing taxes. Links on the IRS website help individuals locate tax accountants or address tax disputes. Referencing official resources supported by the IRS ensures your peace of mind because you can be confident you’re receiving accurate tax advice.

Tax resources save you time.

Issuing tax documents can be a lengthy process. When you have professionally designed tax envelopes, you’ll save yourself time by simplifying the process. The tax envelopes with windows are designed to match the tax software. The tax software positions the sender’s and recipient’s addresses so they appear in the windows. This means you don’t have to address envelopes by hand or attach address labels to the envelope. Instead, you can make use of information already displayed on the enclosed tax documents.

Tax resources identify the content.

Tax envelopes can be marked as first-class mail and confidential, alerting recipients to the importance of the contents and reducing the chances they’ll overlook or misplace the mail because of its significance. Although the post office strives to deliver all mail, items are occasionally misplaced. Still, official envelopes designed for tax returns make it easier to locate missing tax documents if they go astray during the delivery process.

Using tax envelopes helps contractors keep track of tax documents. Contractors may have multiple forms from various clients, and it can be easy to misplace items if they’re in generic envelopes of different sizes.

When clients hire a tax accountant to file their taxes, they want the process to be cost-effective and straightforward. They also want to be able to locate the documents they need with ease. Clients benefit from receiving documents in folders because the contents are organized.

People preparing their taxes may also opt to use folders. Suppose you’re a sole proprietor and have business expenses you can claim on your tax returns. Using official tax folders is a great way to save receipts and other tax documents throughout the year. It’s easier to locate a folder labeled as a tax return folder than a generic folder, making it less likely users will lose track of their tax documents.

Tax resources include stationery products such as envelopes, folders, and forms. Tax resources also include information compiled by the IRS. Using tax resources can save you time and keep you organized as you prepare to issue tax documents or file your taxes.