Your credit score matters. It’s a way for third parties to determine whether you’ll be able to pay off your debts in a timely manner or not. The higher your score, the more favorable a credit risk you are.

Even if you get approved for a loan, what interest rates you’ll pay if you do—depends on your credit score. Insurers (Insurance Companies) also use your credit score to calculate your auto and homeowners premiums.

Also, when you rent an apartment in urban areas, your landlord may check your credit score prior to approving your application.

Most people know the importance of a good credit score, but many are unclear on how to achieve one. And you know what, Achieving a high credit card score is a part of lifestyle these days. So If I ask you few question, Do you have reply of that?

Can debit cards positively affect your credit score? Will a retail card help you build good credit?

Ofcourse, lot of peoples talk about credit cards and bank statements while calculation of credit score but here’s what you need to know about how different cards impact your credit score:

1. You Need More Than a Debit Card

There are many benefits to only paying for purchases with a debit card. One, in particular, is avoiding debt. When you make purchases with your debit card, the money is taken straight out of your bank account.

With a credit card, you are borrowing money that you will need to pay back in full. If you don’t, you’ll be charged interest. Although carrying a balance won’t, in itself, harm your credit rating, experts recommend using less than a third of your available credit at any given time.

The lower you can keep your credit utilization, the better for your credit score.

While debit cards are an excellent way to conduct transactions without incurring debt, they don’t show third parties how you use credit. You’ll find it difficult to get approved for a loan if lenders can’t tell how well you pay back borrowed money.

Employers, lenders, and landlords all run credit reports. Your credit score even determines what kind of credit cards you’re eligible for. These are all important reasons to cultivate your credit score, and smart credit card use is one way to do that.

2. Strive for a Long—and Timely—Credit History

Credit cards impact your credit score the second you apply for one. With that said, it takes time to build your credit score. In general, the longer you have a credit account, the better—especially if you don’t miss your payments.

Credit score models look at the length of your credit history when calculating your credit score. So, it’s a good idea to keep your credit card accounts open and make payments on time every month.

This year, alone, 46 million Americans expect to miss a credit card payment date. And while one missed payment might not seem like a big deal, it can cause a negative chain reaction.

In addition to late fees, you’ll immediately start amassing interest on your outstanding balance. Worse still, a late payment may cause your card issuer to raise your APR.

To make sure you don’t miss payments, consider setting up autopay on your credit card accounts. If your finances don’t allow you to pay off your balance each month, you’ll need to spend within your means.

3. There’s Nothing Wrong With Having Multiple Credit Cards

According to Experian’s 2019 Consumer Credit Review, the average American has 4 credit cards. Is that too many?

There’s a lot of debate on whether having multiple credit cards is a bad thing. Honestly, it depends on the individual. If you’re new to credit cards or have other debt, it’s prudent to start off with just one.

Applying for new credit card accounts usually lowers your credit score a small amount. Furthermore, holding multiple credit cards can be a slippery slope, encouraging rash spending. Having one credit card will help you focus on building your credit without tempting you to make impulse purchases.

On the other hand, if you have excellent credit, you should consider carrying at least two credit cards. The increase in total credit available will boost your credit score. If possible, try to get cards in the same rewards program to maximize your benefits.

The number of credit cards you have doesn’t matter as much as how well you pay them off. If you’re managing your credit well, you could hold multiple cards and still be in good standing.

4. Choose a Credit Card With Strong Fraud Protection

In 2018, almost $28 billion in illegal credit card charges were reported. When choosing a credit card, it’s important you pick one with robust fraud protection.

While the federal Fair Credit Billing Act limits consumer liability for fraudulent charges to $50, some credit card issuers provide zero-liability fraud protection. This means you won’t be required to pay for any unauthorized purchases once you report your card stolen.

Some issuers, like Discover and Capital One, let users lock and unlock their cards via a mobile app. Discover even monitors dark websites for your Social Security number. If it finds a match, the company will notify you immediately so you can take action.

Although credit card companies monitor their users’ purchases, these systems aren’t perfect. It’s important you choose a bank that will go the extra mile to keep your money safe.

5. Retail Cards May Hurt Your Credit Score

Signing up for a retail card might seem like a smart way to snag a discount. But opening one could potentially hurt your credit score—or at least your finances.

Retail credit cards typically have high APRs. This means that if you carry a balance, you’ll spend a great deal on interest. These cards also feature low credit limits, so it’s easier to use up a larger proportion of your credit than with a normal credit card. If you’re not careful, a retail card could spike your credit usage and lower your score.

On the flip side, a retail card could potentially boost your credit score. They’re usually easier to get approved for than a normal credit card. Plus, they report your payment history to credit bureaus on a monthly basis, just like regular credit cards. As long as you pay off your balance each month, a retail card might be exactly what you need to help raise your credit score.

Building a good credit score—and keeping it—isn’t easy. It takes discipline and a clear understanding of how cards work. Simply having a credit card isn’t enough to keep your score high. You need to watch how much you spend, pay your bills on time, and ensure you’re living within your means.

See More:

Fantastic 5 Sources of Data to Boost Your Marketing and Business Efforts

Even though it takes hard work, the payoff is worth it. A high credit score will qualify you for better interest rates, meaning you will pay less finance charges on card balances and loans. The less interest you have to pay, the faster you can pay off debt and achieve your financial goals.

Concluding Words:

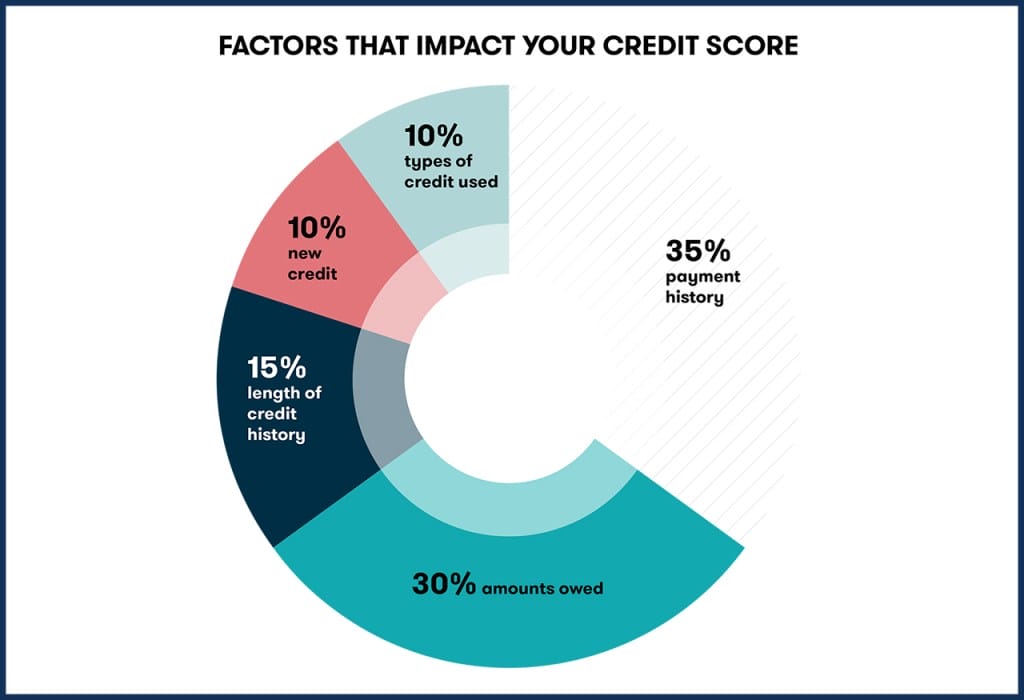

As per the survey, If you consider these 5-factors – You’ll have good credit score always.

- 35% payment history,

- 10% types of credit used,

- 10% new credit,

- 15% length of credit history,

- 30% amount owed

Signing off, If you have any question – please feel free to ask! I hope this article helped you alot and incase, you have any suggestion too, let us know in a comment section.