Few things can compare to the thrill of getting your first “adult” bank account. It feels like an important rite of passage, and for many people, it’s their first taste of financial independence.

But what do you do if your bank doesn’t offer the services you want? Or maybe they have great features but aren’t convenient enough to use daily. In these cases, you often turn to mobile apps like the Chime or Cash app as an alternative to traditional banking institutions and services.

But which one is better for you? Let’s find out –

Chime Overview

Chime is a financial services company that was founded in 2017. The company offers checking, savings, and credit products to consumers.

Chime has an app called the Chime app which you can download on your smartphone or tablet device to use their service. You can also sign up for their service online at www.chime.com and set up your account if you prefer not to use your phone or tablet device (although we recommend using those methods).

The Chime Bank account types are Checking Accounts (with no minimum balance requirement), Savings Accounts (with no minimum balance requirement), and Personal Loans with competitive rates starting at just 5% APR because of that they are recognized as one of the best money lenders in the industry.

There are no fees associated with opening an account or making transfers between linked accounts within Chime Bank; however, fees may be associated with using other third-party services, such as ATMs or overdraft protection plans, depending on what type of product/service they offer.

Cash App Overview

Cash App is a mobile payment platform owned by Square, a company founded by Twitter co-founder Jack Dorsey. The app allows you to send money to friends and family through text messages or email addresses. Thanks to its integration with Apple Pay and Google Pay, you can also use it to pay merchants online or in-store.

Cash App has two account types: Personal and Business (the latter is available only in select states). Both accounts come with no monthly fees, but there are some other charges associated with using the service—more on those later!

In addition to sending money through your phone number or email address, you can do so via a QR code scan from within the app itself—a nice touch that saves time when paying friends back for dinner at their favorite restaurant!

Chime vs. Cash App: Key Comparison Points

- Account Types: Chime offers both a checking (Spending) and savings account, while Cash App primarily focuses on peer-to-peer money transfers with an optional Cash App debit card.

- Fees and Charges: Chime has no monthly fees, overdraft fees, or minimum balance requirements. Cash App charges fees for instant transfers and certain transactions, such as ATM withdrawals and sending money internationally.

- Direct Deposit Features: Chime offers early direct deposits, allowing users to access their paycheck up to two days earlier than traditional banks. Cash App has a direct deposit feature but does not offer early access to funds.

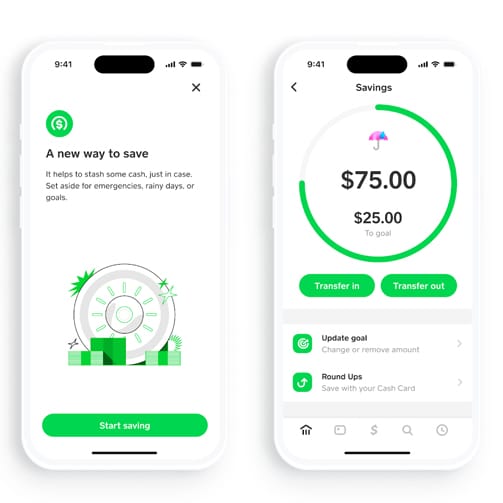

- Savings Features: Chime offers Automatic Savings, rounding up transactions to the nearest dollar and depositing the difference into the user’s savings account. Cash App does not have a built-in savings feature.

- Money Transfer Limits: Chime has higher limits for transactions, allowing users to send up to $2,000 per day and $10,000 per month. Cash App’s limits are lower, with a maximum of $250 per week for unverified users and $2,500 per week for verified users.

- Customer Support: Chime provides customer support through in-app chat, email, and phone. Cash App offers support primarily through email and in-app messaging, with limited phone support.

- Security Features: Both Chime and Cash App have robust security measures, including encryption and account notifications. Chime also offers the ability to freeze and unfreeze your debit card in-app. At the same time, Cash App lets you enable a security lock feature requiring a PIN or fingerprint to authorize transactions.

Pros and Cons of the Chime App

| Pros and Cons of Chime App | Pros | Cons |

|---|---|---|

| Ease of Use | Free, easy to use, only requires phone number or email | Not as widely known as Venmo or PayPal |

| Sending Money | Send money to any Chime user | Limited to Chime users only |

| Automatic Payments | Set up automatic payments to avoid late fees | Free, easy to use, only requires a phone number or email |

| Alternative to Venmo/PayPal | Can transfer money to Chime accounts instead of using other services | Might need to convince others to use Chime |

| Instant Transfers | Instant transfers between Chime users without fees | It might not be suitable for one-time payments |

Pros and Cons of Cash App

| Pros and Cons of Cash App | Pros | Cons |

|---|---|---|

| Availability | Available on Android and iOS devices | Less popular than Chime and Venmo |

| Withdrawal | No fees or minimum balance requirements for withdrawals | May not be suitable as a primary account |

| Overdraft Fees | No overdraft fees due to direct transfers | Limited to Cash App users only |

| Ease of Use | Send money to anyone with a phone number or email address | Might need to convince others to use Cash App |

| Fees | No fees for most transactions | Fees for instant transfers and certain transactions |

| Automatic Payments | Supports automatic payments for some services | Limited compared to other payment apps |

| Sending Money | Easy to send money to other Cash App users | Lower transfer limits compared to Chime |

Chime vs. Cash App: Use Cases

As someone who values convenient daily banking and budgeting, Chime is the perfect app for you. It offers a wide range of financial services that cater to your needs, including easy deposits and withdrawals, seamless money transfers to friends, and online bill payments.

You can also enjoy benefits like no fees for users under 21 years old and a free checking account without minimum balance requirements or monthly service charges (although a small deposit is needed).

On the other hand, if you’re looking for a quick and efficient money transfer solution, Cash App is your go-to choice.

It’s especially suitable for small business owners and freelancers like yourself who need a hassle-free way to collect payments from clients or receive funds without setting up complex PayPal payment plans.

With Cash App, you can instantly transfer funds from your account balance to your bank account. Just enter your bank details once, and each time a client pays you via PayPal Direct Payments within 48 hours of accepting the terms, the money will be sent directly to your linked bank account, streamlining your transactions and saving you time.

Final Verdict: Which App Comes Out on Top?

When comparing Chime and Cash App, both have their unique advantages.

However, if you value quick money transfers and ease of use in receiving payments from clients or friends, then Cash App is undoubtedly the perfect choice.

While Chime has its perks, Cash App’s instant payout feature and simplicity make it a more suitable option for those who prioritize speedy transactions.

Furthermore, both options provide free checking accounts with no monthly maintenance fees or minimum balance requirements, so you can enjoy the benefits of the Cash App without compromising on essential banking features.

Winner: Cash App