Do you need money but don’t know where to get it?

The idea of payday loans might tempt you. Payday loans are short-term cash advances that let you borrow a few hundred bucks from your bank account or credit card.

They’re usually due on your next payday, which gives them their name. But when you’re in a bind and need fast cash, they can be attractive if you can afford the interest rates and fees.

That’s why it’s good to have other options: apps like Possible Finance (and others) that let you access your pay as soon as it arrives instead of waiting for payday!

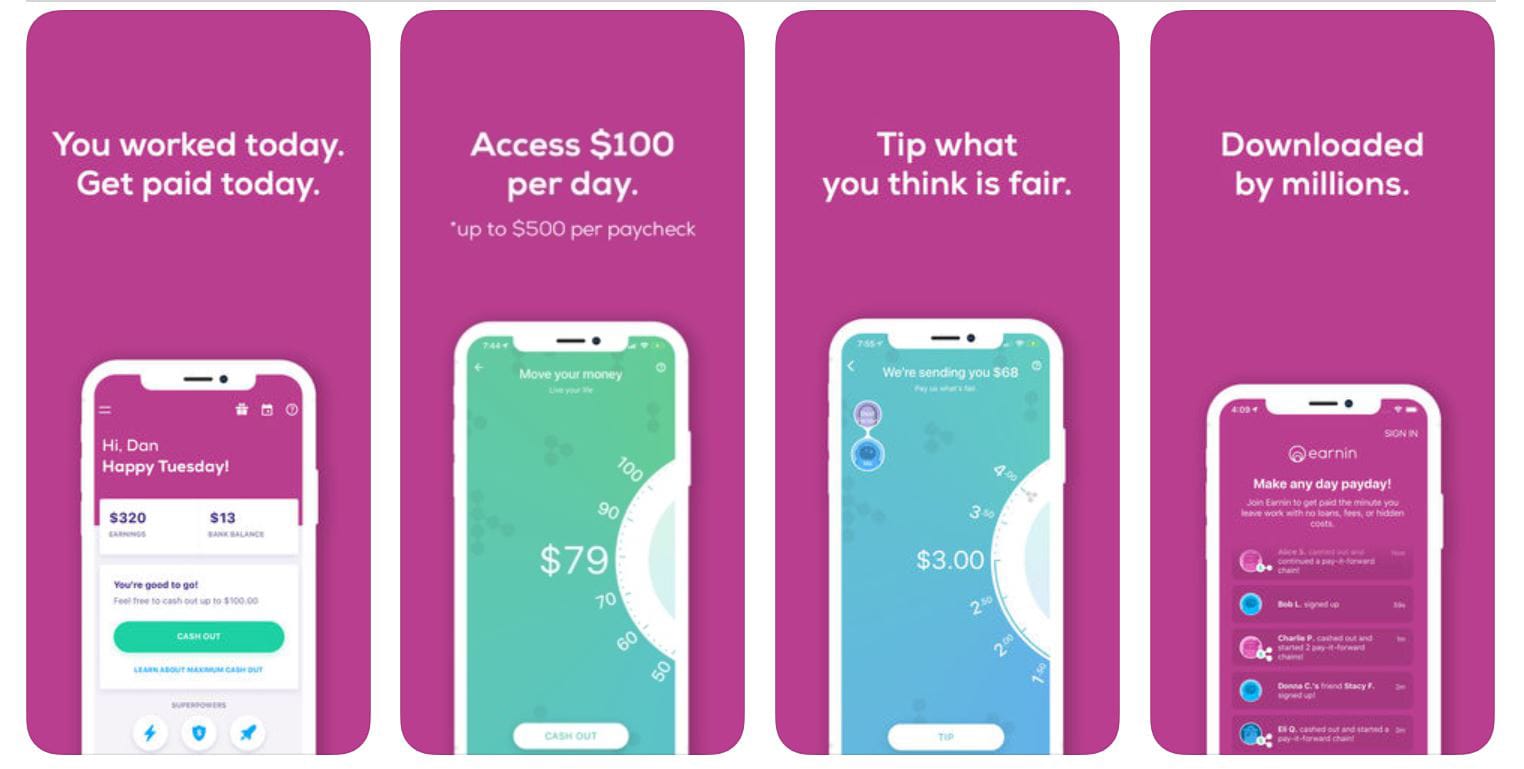

Earnin

Earnin is a free app that lets you get paid by doing things you already do online. It’s available in the U.S. and pays users for completing tasks such as shopping, watching videos, and taking surveys.

Anyone can join the Earnin community—download the app to get started and link your checking account so that your earnings can be deposited directly into it on payday (or whenever you request). You can also choose to take advantage of other optional ways to earn money through this app:

- Become an affiliate: Earn 10% cash back when people use your referral code when signing up for Earnin or making purchases on Amazon using their unique link.

- Refer friends: Refer friends using your unique link, and receive $5 per person who signs up through it!

Branch

Branch is a peer-to-peer lending app that allows you to borrow up to $100,000. If you’re looking to borrow more money than that, however, they also offer an online personal loan service through the same website.

As with all peer-to-peer lending apps, Branch’s rates are higher than those of traditional lenders like banks because there’s no opportunity for profits from interest rates or fees on loans (since there are none).

But if your credit score is in good shape and you have plenty of income to cover the monthly payments on a personal loan from a Branch or another peer-to-peer lender, this could be your best option.

Dave

Dave is a financial technology company offering payday, installment, and personal loans. The app is available in all US States and can be used on Android and iOS devices. The minimum loan amount is $100; the maximum is $1,000.

The application process takes just minutes and lets you borrow up to $500 for 30 days with no interest or fees if paid back early.

You’re charged a 4% fee for every extension beyond 30 days (up to 60 days) with no additional interest charges if paid back within 90 days of the initial approval date.

Brigit

Brigit is a new way to get a short-term loan. You can apply in minutes and get up to $2,000, which you can use for anything.

It’s all through the app and takes less than 10 minutes. The great thing about Brigit is that it gives you flexibility: if you have an emergency expense and there’s no other way to pay it.

Still, then you’re able to pay back some or even all of your loan amount within 24 hours; Brigit has made it possible for us to give our customers control over their credit decisions so they can decide how much they want or need – no matter what the money is for.

Chime

Chime is a mobile-first financial institution that provides simple and affordable banking solutions, including using your paycheck advance to pay off existing debt. The Chime app is available on iOS and Android devices 24/7. You can also view recent transactions, track spending habits, find ATMs nearby, and more.

If you want to consolidate multiple debts with one lender and pay off those debts in full with a single loan (or even two), then Chime might be your best option.

Moneylion

Moneylion is a fintech company that offers online payday loans. The app is available for iOS and Android so that you can use it with your phone or tablet.

The app is easy to use, with clear information about the loan process and what to expect when you apply for one.

You’ll need to provide some personal data like your name, address, Social Security number (if you have one), bank account information, and driver’s license number—but if this sounds daunting, take comfort in knowing that Moneylion uses an encrypted connection for all communications between its system and yours.

And once you complete the loan approval process, you’re all set to receive the money directly to your bank account.

Flexwages

Flexwages is a free app that lets you get paid on your schedule. It’s available in the US and works with all central banks and credit unions.

You can set up automatic deposits, request a loan and cash advances, and even transfer money to other Flexwage users without fees.

Money 4 You Payday Loans

Money4You Payday Loans is a UK-based company that offers payday loans to UK residents. The company has been in business for over 15 years and has an A+ rating from the Better Business Bureau (BBB).

Money4You Payday Loans offers a variety of loan options, including:

- Short-Term Loans – These loans range from £100 to £1,000 and are approved within minutes. They can be used for any emergency expense or purchase you might need money for.

- Long-Term Loans – These larger loans are available up to £25,000 and have terms ranging from 6 months to 24 months. If you have more time than money and want to pay off your bill over time, this may be the best option available through Money 4 You Payday Loans.

Money 4 You Payday Loans also offers competitive interest rates and flexible repayment options, so paying back your loan is even easier than borrowing one! In addition, they offer 24/7 customer service so that no matter where life takes you, there will always be someone there waiting patiently on the phone, ready to help.

LendUp

LendUp offers loans from $500 to $5,000. You can apply for a loan with LendUp’s mobile app or website. The company claims that it takes just 15 minutes to review your application, and you can be approved for a loan in as little as five minutes.

LendUp offers fixed-rate loans from 5.99% APR up to 24.99%. The more money you borrow, the higher your rate will be; but if you’re looking for a short-term personal loan and don’t need much cash upfront, this could be worth considering.

ACE Cash Express Mobile Loan App

ACE Cash Express is a payday loan lender that offers short-term loans from $100 to $1,000. Borrowers can apply for ACE Cash Express Mobile Loan App using their smartphone and receive their cash directly on the spot.

ACE Cash Express operates in all 50 states, and its mobile app allows users to get approved for a loan quickly without ever having to leave their homes or office.

MaxLend Loans

MaxLend is an app that lets you apply for loans in just minutes. It’s available in the US, UK, and Canada, so if you’re looking for a quick solution to your financial problems, this could be one of the best payday loan apps.

The loan process is simple: fill out the online form with some basic information about yourself, receive a quote from MaxLend within 30 seconds (or less), then choose whether or not to accept it before completing your application. Once approved, funds will be deposited into your bank account as soon as possible—usually within 24 hours but sometimes even sooner!

MaxLend offers loans up to $1,500, but no hidden fees or interest rates are associated with these loans. There may be an origination fee depending on how much money you take out, but this varies depending on what state (or country) you live in, so check their website before applying for any amount larger than $100 via the app itself, which should include all relevant information needed by those living outside North America who don’t have access yet.

Tala App

Tala App is an online lending app you can use to borrow money. It’s available for iOS and Android devices and doesn’t require a credit check, so that you can get approved for a loan in minutes.

Tala makes payday loans available to people in the United States and Britain—and you don’t need a credit history to get a loan from them.

That said, Tala does charge fees for its services: $10 when you submit your application, another $10 if it takes more than three days to receive your money transfer notification (which includes the amount of your loan), plus additional charges for any overdraft fees on your account within the first 30 days.

The interest rate on this type of debt is fixed at 25 percent APR.

Conclusion

These loans are great for anyone who needs money in an emergency and doesn’t have access to a traditional bank account. If you’re looking for a fast way to get cash without hidden fees, these apps, like possible finance, can help.