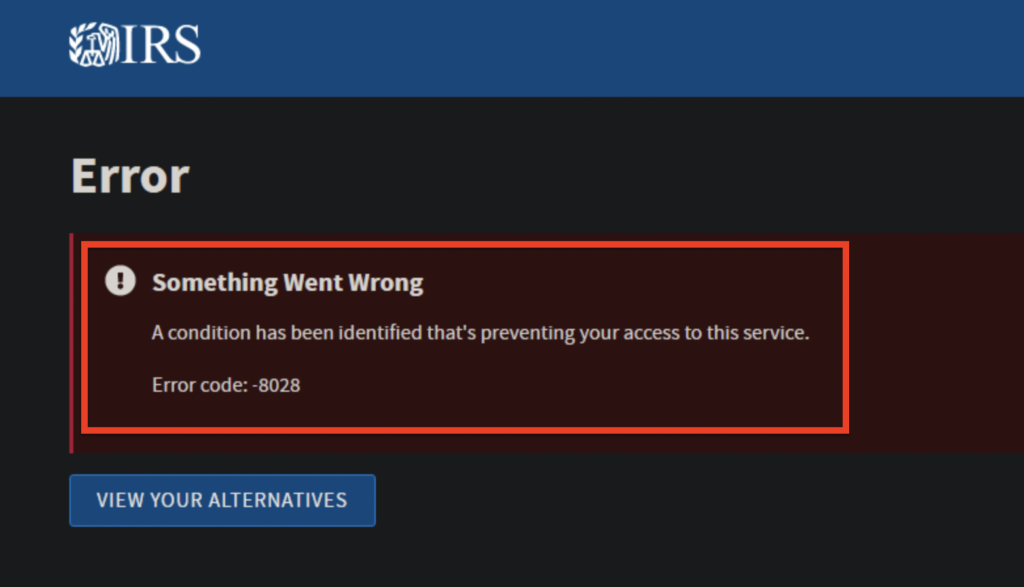

Has the IRS Error Code 8028 pulled the brakes on your tax filing process? Don’t let this speed bump turn into a roadblock.

I know it can be frustrating when an unknown IRS error code derails the tax filing process.

In reality, it’s a common issue that many taxpayers face. So, this concise guide reveals what Error Code 8028 really means and provides practical steps to resolve it.

Now, let’s get started with the fix –

What is IRS Error Code 8028?

Error Code 8028 is one of the multiple codes you might encounter when dealing with the IRS. Now, this might sound intimidating, but don’t worry – it’s more common than you think and usually triggered due to temporary issues in the IRS system.

More specifically, if you see this particular error code, it indicates that your TIN (Taxpayer Identification Number) ID has been placed on a restricted list. This might happen for multiple reasons, from security concerns to possible glitches.

Common Causes of IRS Error Code 8028

1. Mismatched Personal Information

One of the most frequent causes of Error Code 8028 is a discrepancy between the personal information submitted and what the IRS has on file. This could include differences in spelling, incorrect SSN, TIN, or EIN, or errors in addresses.

2. Outdated Tax Software

Using outdated tax filing software can also lead to Error Code 8028. If your software is not up-to-date, it might not support the latest IRS forms or procedures, leading to submission errors.

3. Temporary IRS System Issues

Sometimes, the error may be due to temporary issues with the IRS system, such as technical glitches or server maintenance. During these periods, the IRS systems may be unable to process return filings or cause unexpected errors.

4. High Traffic Volume on IRS Website

During the tax season, the IRS website experiences a significant increase in visitors, resulting in a higher server load. This can cause slow response times, server time-outs, and temporary errors, including Error Code 8028.

5. Poor Network Connection

An unstable or weak network connection can cause issues with the IRS website. The error could result from interrupted data transfer or lost connection to the IRS server.

6. Browser Cache and Cookies

Your browser may have stored outdated or corrupt cache and cookie data related to the IRS website. This can cause an error in rendering web pages properly or logging in to your account.

7. Browser Extensions and Plugins

Certain browser extensions or plugins, such as security or ad-blockers, can interfere with the functionality of the IRS website, preventing proper communication and leading to errors like Code 8028.

8. Device or System Issues

Your device or its settings may have issues that are not immediately apparent but can impact the tax filing process. Outdated or unsupported browser versions, software conflicts, and incorrect system settings could result in IRS Error Code 8028.

Understanding the causes of this error makes it easier to identify the issue and effectively troubleshoot it. Through a thorough and systematic evaluation of these factors, you can address the root cause of Error Code 8028 and successfully file your taxes.

How to Fix IRS Error Code 8028?

Below are the detailed steps to resolve the IRS Error code 8028:

1. Wait for a While

Technical glitches or temporary issues might cause this error. Give it a few hours, then try filing your return again.

2. Change the Network Connection

- Switch to a different network (e.g., from Wi-Fi to wired connection or mobile data).

- Restart your router.

3. Verify Your Information

- Review your income tax documents’ SSN, TIN, and EIN to ensure they match IRS records.

- Correct any discrepancies and resubmit.

4. Update Your Software

- Open your tax filing software.

- Search for updates and install the latest version.

5. Clear Browser Cache and Cookies

- In your browser settings, locate the option to clear cache and cookies using the CCleaner app.

- Click the option to clear cache and cookies.

- Restart your browser and attempt to reaccess the IRS website.

6. Disable Browser Extensions

- Access your browser settings or add-ons/extensions menu.

- Temporarily disable all extensions.

- Restart your browser and try reaccessing the IRS website.

7. Restart Your Device

- Shut down your computer, smartphone, or tablet completely.

- Wait for a minute, and then start the device again.

- Access the IRS website.

8. Try Using Another Device

- Use a different computer or smartphone to access the IRS website and see if the issue still persists.

9. Try Creating A Regular IRS Account

- Go to the IRS website.

- Click on “Create New Account” or “Register.”

- Enter your personal information and follow the prompts to complete the registration.

- Log in to your new account and verify that your information matches IRS records.

10. Wait And Try Again

Attempt your tax return during off-peak hours, such as early morning or late night.

11. Check IRS Server Status

- Visit the official IRS website or search for “IRS server status” on a search engine.

- Verify if there have been any server outages or maintenance activities on the IRS website.

12. Contact IRS Customer Care

- Visit the IRS website and locate the “Contact Us” page.

- Call the phone number provided for individual or business tax assistance.

- Explain your issue to the customer care representative and follow their instructions to resolve Error Code 8028.

Tips to Prevent IRS Error Code 8028 in the Future

Here are the tips to prevent IRS error code 8028 in the future:

- Regularly update your tax software to ensure compatibility with the latest IRS processes and forms.

- Double-check your personal information, such as your SSN, EIN, TIN, and address, to ensure they match the IRS records.

- Ensure a stable and strong internet connection when preparing and submitting tax returns to avoid issues.

- Frequently clear your browser’s cached data and cookies to prevent web page rendering and login issues.

- Manage your browser extensions well or disable them while using the IRS website to prevent interference.

- To avoid high-traffic periods and potential server issues, try to file your returns during off-peak hours.

- Keep your device’s operating system and browser updated to ensure compatibility and reduce potential conflicts.

Frequently Asked Questions

Here are answers to some common queries about IRS Error Code 8028.

Q1. Is the IRS website down?

If you’re experiencing difficulties accessing the IRS website, it could be down due to scheduled maintenance or temporary server issues. You can check the IRS server status by searching “IRS server status” in a search engine or visiting the official IRS website for any reported outages.

Q2. What to do when getting the IRS Error Code 8028 repeatedly?

If you repeatedly encounter Error Code 8028, contacting IRS customer support is best. The error could be due to an issue that requires administrative resolution.

Q3. Is it possible to fix IRS Error Code 8028 on my mobile?

Yes. The solutions for resolving Error Code 8028 apply to desktop and mobile devices. Ensure your mobile device has a stable internet connection and an up-to-date browser or tax app.

Q4. What are some browser requirements to avoid IRS Error Code 8028?

While there are no specific browser requirements, it’s recommended to use a modern, updated browser. Also, disabling browser extensions that could interfere with the IRS website might prevent Error Code 8028.

Q5. Is IRS Error Code 8028 a serious issue?

Error Code 8028 itself is not serious and does not indicate any major problems with your tax return. However, persistent errors can delay your return filing, leading to late submission penalties.

Final Thoughts

In conclusion, IRS Error Code 8028 is like a red flag that something needs fixing. It could be your internet device or an issue from the IRS.

But don’t worry, you can fix it!

Try waiting, changing your internet, updating your software, or even restarting your device. If nothing works, ask the IRS Customer Care for help.

So, if you see IRS Error Code 8028, stay calm, follow these steps, and you’ll get your tax filing done in no time!